Corporate Governance

Basic Approach

Kanadevia recognizes that responding sincerely to the expectations of stakeholders including shareholders, customers, business partners, social, and employees and ensuring management soundness, transparency, and efficiency are essential for sustainable growth and enhancement of medium- to longterm corporate value, and we are working on enhancing corporate governance as an important management issue.

Board of Directors

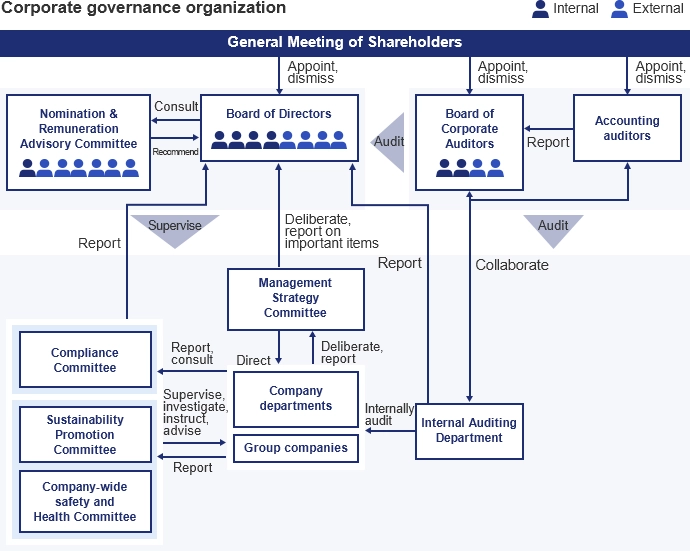

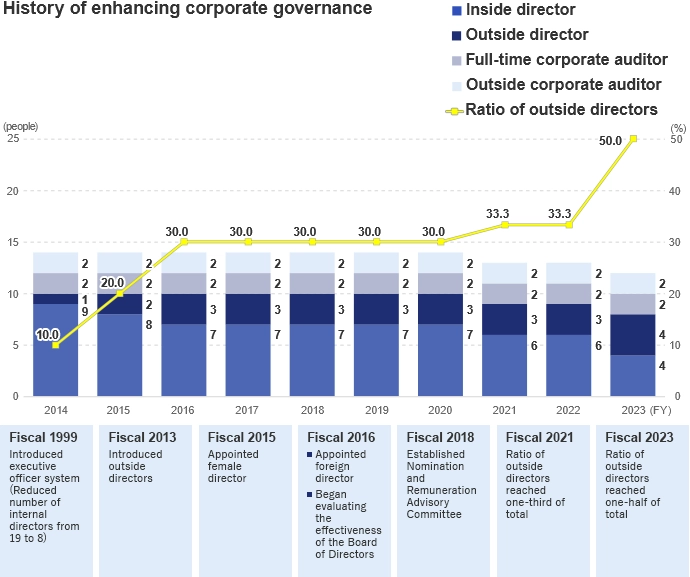

Since June 2023, the Board of Directors has consisted of eight members (including four independent outside directors), a reduction of one member. To further strengthen our governance system, we have increased the number of independent outside directors by one, with independent outside directors now accounting for half of the Board, and from the perspective of expertise and diversity, we have one non-Japanese director and two female directors. In addition to making decisions on matters prescribed by laws, basic management policies and strategies, and other important matters, the Board supervises business execution. The Company has established an executive officer system, under which some of the business execution functions of directors are delegated to executive officers (20 persons), in order to strengthen the supervisory function of the Board of Directors and ensure speedy business execution. Furthermore, by establishing the Management Strategy Committee, we have created a framework to ensure that discussion and decision-making on basic policies and priority measures concerning business management and operations are conducted in a timely and accurate manner. Matters of particular importance are discussed by the Management Strategy Committee and then thoroughly discussed by the Board of Directors before a decision is made on whether or not to proceed.

- Number of meetings held in the fiscal year ended March 31, 2023: 14 Attendance rate: 100%

Board of Corporate Auditors

The Company has adopted a corporate auditor system. Corporate auditors hold Board of Corporate Auditors meetings to consolidate audit opinions. In addition, they monitor and verify the development and operation status of the internal control system, and take necessary measures such as giving advice and recommendations to directors and executive officers as needed. Furthermore, all four corporate auditors, including two outside corporate auditors, attend Board of Directors meetings, and the two full-time corporate auditors also attend important internal meetings including the Management Strategy Committee, expressing opinions from a neutral standpoint and auditing the business execution of directors and executive officers.

- Number of meetings held in the fiscal year ended March 31, 2023: 8 Attendance rate: 100%

Nomination and Remuneration Advisory Committee

Kanadevia established the Nomination and Remuneration Advisory Committee as a voluntary advisory body in 2018 with the aim of ensuring objectivity and transparency of procedures and fulfilling accountability by having important matters related to the nomination of director and corporate auditor candidates, appointment and dismissal of the President and Representative Directors, and remuneration of directors deliberated and answered by a voluntary committee before being deliberated and decided by the Board of Directors.

The committee consists of seven members in total, with independent outside director as the chairperson, and includes the other three independent outside directors, two outside corporate auditors, the Chairperson of the Board CEO. By obtaining appropriate involvement and advice from six outside officers, we aim to ensure transparency, appropriateness, and objectivity in officer personnel matters and director remuneration.

- Number of meetings held in the fical year ended March 31, 2023: 5 Attendance rate: 100%

Evaluation of Board of Directors Effectiveness

Purpose

Based on the belief that identifying issues related to the functions and operations of the Board of Directors and actively working on improvements will contribute to strengthening corporate governance and ultimately enhancing corporate value, we have been conducting evaluations of the effectiveness of the Board of Directors once per fiscal year since FY2016.

Method of Evaluation

We conducted questionnaires targeting all directors and corporate auditors. See the Corporate Governance Report for the specific evaluation procedures and schedule are as follows.

Questionnaire Items

Multiple questions were asked in each of the following five categories, which were rated on a five-point scale and in an open-ended format.

Questionnaire items are determined based on issues at the Company as well as changes in the external environment.

- 1Roles and responsibilities of the Board of Directors

- 2Stimulation of discussions

- 3Board composition and system

- 4Optimizing the conduct of meetings

- 5Roles of the Nomination and Remuneration Advisory Committee

Overview of the fiscal year ended March 31, 2023 evaluation results

The evaluation of the Company's Board of Directors indicated that sufficient time was allocated for deliberation, and materials and explanations were provided to stimulate lively discussions on important agenda items, including the review of the longterm vision, formulation of the new Medium-term Management Plan, promotion of sustainability, selection of focused businesses through portfolio management, and development of executive leadership. We confirmed that the Board as a whole is effectively fulfilling its role, although some improvements and refinements in its operational methods are needed.

Initiatives for Board of Directors Issues

The status of initiatives in the fiscal year ended March 31, 2023 for issues identified in the fiscal year ended March 31, 2022 effectiveness evaluation and opinions from outside directors and corporate auditors are as follows.

| FY2022 action plan |

Incorporate the following important themes into the annual operational plan and make efforts to ensure sufficient time for discussion.

|

|---|---|

| Key actions taken in FY2022 |

Based on the annual operational plan, the above important themes were discussed with sufficient time for deliberation. (Key themes)

|

| Opinions of outside directors and corporate auditors |

|

| FY2023 action plan |

Include the medium- to long-term human resources strategy, overseas strategy, DX strategy, sustainability promotion, and investment projects as key themes for further discussion in the annual operating plan. |

| FY2022 action plan |

Work to strengthen the Nomination and Remuneration Advisory Committee function; promote discussion on succession planning, requirements for the appointment of directors and executive officers, executive remuneration system, etc.; and reinforce the governance framework. |

|---|---|

| Key actions taken in FY2022 |

The Board of Directors strengthened the governance framework through deliberations on important themes. In addition, the Nomination and Remuneration Advisory Committee met five times to discuss the succession plan and the executive skills matrix, including those of executive officers, and launched the Management Human Resources Training Program. |

| Opinions of outside directors and corporate auditors |

|

| FY2023 action plan |

Include corporate governance (roles of the Board of Directors and the Management Strategy Committee, succession planning, executive remuneration system, etc.) as a key theme for further discussion in the annual operating plan. |

| FY2022 action plan |

Expand discussions in FY2022, particularly those related to the creation of a long-term vision and the next medium-term management plan, while improving the selection of themes and material content. |

|---|---|

| Key actions taken in FY2022 |

Discussions were focused on the Sustainable Vision and the Seven Pillars of Success (Materialities). Free and lively discussions at informal board meetings helped shape deliberations at the Board of Directors meetings and contributed to the decision-making process for the Sustainable Vision and the Seven Pillars of Success. |

| Opinions of outside directors and corporate auditors |

Informal board meetings are useful as a forum for the open exchange of ideas and opinions. Consideration should be given to how time is allocated, what topics are discussed, and how to encourage lively discussion. |

| FY2023 action plan |

Continue to hold informal board meetings in FY2023, after careful consideration of the topics for the meetings, as they are an important complement to the Board of Directors meetings. |

| FY2022 action plan |

Enhance the quantity and quality of preliminary briefings for outside officers. Particularly important and urgent themes will be given more opportunities and time for explanation than in the past, and we will focus on ensuring that outside officers have sufficient understanding of these themes to encourage lively deliberations at the Board of Directors meetings. |

|---|---|

| Key actions taken in FY2022 |

|

| Opinions of outside directors and corporate auditors |

|

| FY2023 action plan |

Strive to share management information with outside officers, and to stimulate discussion by providing opportunities for outside officers to exchange opinions with each other. |

| 2022 | 2023 | Total | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | ||

| Board of Directors meetings | 1 | 2 | 2 | 0 | 1 | 2 | 0 | 1 | 2 | 0 | 1 | 2 | 14 |

| Board of Corporate Auditors meetings | 0 | 2 | 2 | 1 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 8 |

| Nominating & Remuneration Advisory Committee meetings | 1 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 5 |

| Informal board meetings | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Opinion exchange meetings between outside officers and management | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 2 |

| Management Strategy Committee | 1 | 2 | 2 | 2 | 2 | 2 | 1 | 3 | 2 | 1 | 3 | 2 | 23 |

Key Themes at Board Meetings

① Medium- to long-term Strategy (formulation of next Medium-term Management Plan)

In reviewing the Medium-term Management Plan Forward 22 (FY2020–2022), the business execution department reported on changes in global social conditions and the market environment surrounding the Kanadevia Group. In response to these changes, the department also proposed a new Sustainable Vision as a vision of what the Company aims to be by 2050, and to revise part of the existing long-term Kanadevia 2030 Vision as a milestone toward achieving the Sustainable Vision, as well as formulating new Medium-term Management Plan Forward 25 (FY2023–2025) as the first step toward achieving these long-term management visions. In response to these proposals, Outside Directors and Outside Corporate Auditors discussed the feasibility of the financial targets of the long-term vision and the new Medium-term Management Plan, the need to follow up and evaluate progress by setting KPIs for measures, specific policies for business investment strategies and risk management, and how to proceed with measures to strengthen human capital, a key issue for the entire company. Outside Directors and Outside Corporate Auditors offered their opinions from a wide range of perspectives based on their respective expertise, which led to a lively discussion. After a vote, the proposal was approved as proposed.

② Promoting Business Portfolio Management (spin-off of marine diesel engine business and collaboration with Imabari Shipbuilding)

The business execution department proposed the establishment of a new company to operate the marine diesel engine business with capital participation by Imabari Shipbuilding Co., Ltd. in order to improve the profitability of the business and reduce management risk. The business execution department reported the following three points as the reasons for cooperation with Imabari Shipbuilding: 1) Sales expansion by strengthening the sales and supply network, 2) profitability improvement through cost reduction and productivity enhancement by optimizing material procurement, and 3) Contribution to greenhouse gas (GHG) emission reduction by developing and supplying next-generation fuel-compatible engines. In response to this proposal, outside directors and outside corporate auditors pointed out the need to rearrange the positioning of the marine diesel engine business in the business portfolio, the terms of cooperation with Imabari Shipbuilding, and the new company’s policy for hiring and training personnel, which led to a lively discussion. After a vote, the proposal was approved as proposed.

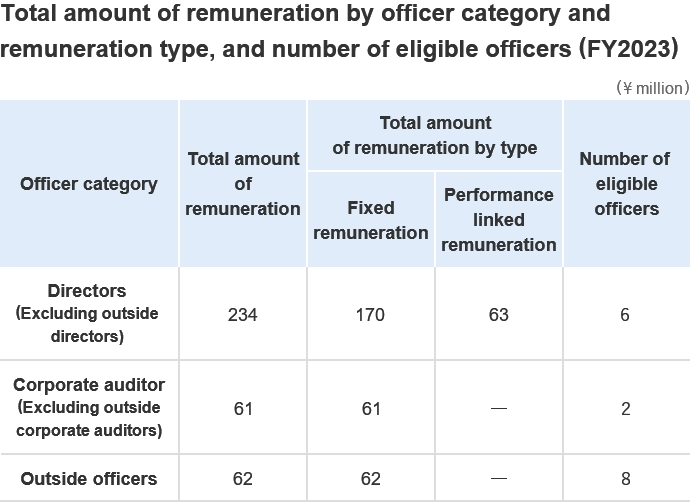

Officer Remuneration

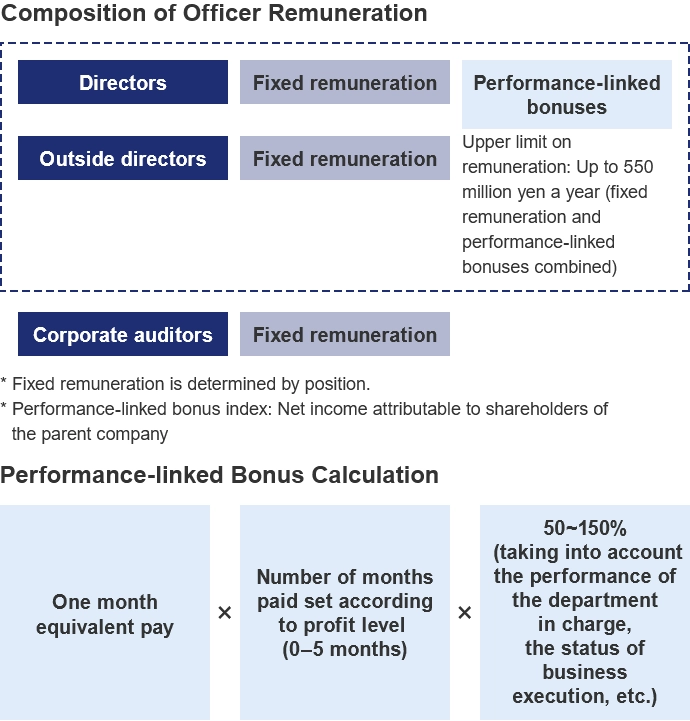

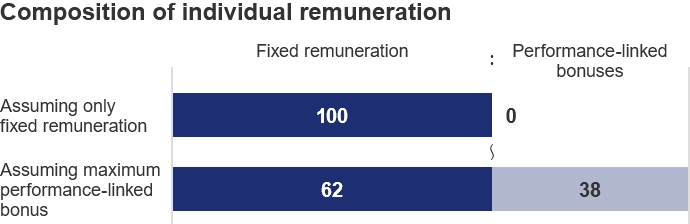

Remuneration for directors comprises fixed remuneration and performance-linked bonuses and is decided for individual directors within the total amount of remuneration approved by a resolution of the General Meeting of Shareholders. So as to ensure their independence, remuneration for outside directors consists only of fixed remuneration.

In determining the remuneration for the senior management team and directors, the Nomination and Remuneration Advisory Committee reports to the Board of Directors on the remuneration provisions and levels, which are discussed by the Board before a decision is made. The Nomination and Remuneration Advisory Committee regularly reviews the remuneration provisions and levels to ensure that the remuneration provides a sound incentive for directors.

Retirement bonuses for officers have been abolished.

Policies and Procedures for Appointing Senior Management Team and Director Candidates

To achieve sustainable growth and enhance our corporate value over the medium to long term, we believe that successor development, including for the CEO position, is one of the most important strategic decisions in our Group’s management. Senior management team members must possess a mindset, skills, and ability to act appropriate to lead the Group and implement the corporate philosophy. When appointing and removing senior management team members, the Nomination and Remuneration Advisory Committee discusses the issue, and then the Board of Directors conducts further discussions and decides on the issue. Director and corporate auditor candidates must possess not only outstanding character and insight but also the knowledge, experience, and skills to appropriately execute the duties required of their position. Outside director and outside corporate auditor candidates must possess abundant experience, expertise, and broad insight related to corporate management and meet the Company’s independence criteria. As for the successor development plan, the policy was decided on by the Board of Directors in February 2020 after consulting with the Nomination and Remuneration Advisory Committee. At the current time, we are moving forward with fostering CEO candidates based on this plan. The Nomination and Remuneration Advisory Committee receives regular reports on the state of development, and we will steadily move forward with training while receiving advice from the committee.

- The ideal CEO should have

-

- 1The ability to act in accordance with our corporate philosophy

- 2Enough energy and physical strength to fulfill the intense workload as a top executive

- 3Goals to achieve as a top executive (values, ambition, and persistence)

- 4Appropriate personality to be a top executive (character, dignity, integrity, and intelligence)

- 5Humanistic appeal in terms of aspirations, dreams, philosophy and trust of all employees

- 6The ability to strive to understand unfamiliar businesses and manage from a long-term perspective

- 7The ability to make calm and precise decisions and fulfill the responsibilities even under uncertain circumstances

- 8Sufficient knowledge and skills to assume the duties of a top executive

- 9The ability to maintain an innovative mindset and combine innovation with creation

- 10The ability to establish a vision as a top executive and lead all employees

Skills and Matrix

The Board of Directors decided on the skills that the Board as a whole should have to ensure the sustainable growth of the Group and the achievement of its management objectives, following deliberations by the Nomination and Remuneration Advisory Committee.

- Main Approach

- ■ As a company that advocates “technology and sincerity” in its corporate philosophy and claims to be a technology-driven company, technology-related skills are essential

■ Skills to contribute to our management strategy of expanding overseas businesses and growing services that leverage ICT (stable sources of earnings)

■ Skills to perform the corporate and governance functions necessary to promote the above

| Corporate management | Experience as a top executive (e.g., full-time chairperson, president, vice president, or other representative directors) in the Company, its affiliates, or other companies |

|---|---|

| Sales, marketing, innovation | Experience as a line manager at or above the divisional level in sales* or as a sales planning manager |

| R&D | Technical executives (those with science and engineering backgrounds and experience in development departments) |

| Estimate, engineering, manufacturing, procurement | Technical executives (those with engineering or factory division experience), or experience as a procurement division manager |

| Finance and accounting | Experience as a line manager at or above the divisional level in finance and accounting* |

| Human resources development, diversity | Experience as a line manager at or above the divisional level in human resources and general affairs* |

| Legal affairs and risk management | Experience as a line manager at or above the divisional level in legal affairs or risk management* |

| ICT, digital | Experience as a line manager at or above the divisional level in ICT* |

| Global | Experience as an expatriate, project manager, or equivalent manager in overseas local construction |

Executive Skills Matrix

| Position (as of July 1, 2023) |

Gender (  indicates female) indicates female) |

Corporate management | Sales, marketing, innovation | R&D | Estimate, engineering, manufacturing, procurement | Finance and accounting | Human resources development, diversity | Legal and risk management | ICT, digital | Global | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Directors | Representative Director President & Chief Executive Officer Sadao Mino |

|

|

|

|

||||||

| Managing Director Tatsuji Kamaya |

|

|

|

||||||||

| Managing Director Tadashi Shibayama |

|

|

|

|

|||||||

| Representative Managing Director Michi Kuwahara |

|

|

|

|

|

||||||

| Outside Director Richard R. Lury |

|

|

|||||||||

| Outside Director Tetsuya Shoji |

|

|

|

|

|

||||||

| Outside Director Shinoi Sakata |

|

|

|

|

|||||||

| Outside Director Akiko Horiguchi |

|

|

|

|

|||||||

| Corporate Auditors | Full-time Corporate Auditor Kazuhisa Yamamoto |

|

|

|

|||||||

| Full-time Corporate Auditor Masayuki Morikata |

|

|

|

||||||||

| Outside Corporate Auditor Hirofumi Yasuhara |

|

|

|

||||||||

| Outside Corporate Auditor Makoto Araki |

|

|

|

|

|||||||

| Position (as of July 1, 2023) |

Gender (  indicates female) indicates female) |

Corporate management | Sales, marketing, innovation | R&D | Estimate, engineering, manufacturing, procurement | Finance and accounting | Human resources development, diversity | Legal and risk management | ICT, digital | Global | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Senior Managing Executive Officer | Satoshi Kimura |  |

|

||||||||

| Hitoshi Kogi |  |

||||||||||

| Yuichi Ohkura |  |

|

|

|

|

||||||

| Managing Executive Officer | Mitsutoshi Tsukasaki |  |

|

|

|||||||

| Tomonori Kawatsu |  |

|

|

|

|||||||

| Munenobu Hashizume |  |

|

|||||||||

| Shinji Shimamura |  |

|

|

|

|

||||||

| Executive Officer | Takashi Ibe |  |

|

||||||||

| Tetsuro Iwashita |  |

|

|||||||||

| Toshihiko Yasuda |  |

|

|||||||||

| Toshiki Nakamura |  |

||||||||||

| Akira Kamaya |  |

||||||||||

| Toshifumi Makihata |  |

||||||||||

| Hiroshi Miyazaki |  |

|

|||||||||

| Koichi Hinami |  |

|

|||||||||

| Koichi Kaibuchi |  |

|

|||||||||

| Takashi Fujita |  |

|

|

||||||||

| Mamoru Kondo |  |

|

|||||||||

| Tadashi Iwanaga |  |

|

|

||||||||

| Takeshi Minemura |  |

||||||||||